Check and Dispute Credit Report Errors

Begin by reviewing your credit report for free from Equifax, Experian, and TransUnion. If you spot mistakes, contest them promptly. Incorrect negative items can lower your score, and the Federal Trade Commission reports that credit errors are quite common1.

To dispute an error, use a free template from the Consumer Financial Protection Bureau. It's better to handle these issues yourself rather than paying expensive repair companies.

Steps to Dispute Errors:

- Contact both the bureau and the creditor

- Describe the problem in detail

- Include supporting documents

- Follow up if no response within 30 days

If your claims are validated, your credit score might improve quickly. Going forward, pay all bills on time, including credit cards and utility bills. Setting up automatic payments can help avoid missed payments that can affect your report for years.

Also, keep an eye on your credit utilization. Aim to keep your credit card balances below 30% of your total available credit. High utilization can deter lenders, so keeping it low is crucial.

Lastly, watch for any unauthorized new accounts. If you see a new line of credit you didn't open, report it immediately as it could be fraud and harm your score.

Pay Bills On Time

Late payments can seriously damage your credit score. A single late payment can stick to your credit report for up to seven years, which isn't ideal when applying for a mortgage.

"Setting up automatic payments is like having a personal assistant without the hefty salary. Your bills will be paid on time, every time, eliminating the guesswork."

Consider setting up alerts with your financial institution to remind you when payments are scheduled, ensuring funds are available. It's a built-in safety net for potential issues.

Keep a "payment buffer" – your financial cushion – in your account. This covers you if payday is delayed or an unexpected expense arises.

If you do miss a payment, address it immediately. Call the creditor; sometimes, they'll waive the late fee if you have a good record.

Remember, this isn't just about paying bills. It's about building financial trust and character. Lenders appreciate a history of on-time payments because it signals reliability and responsibility – traits that say "I'm financially responsible and you can trust me with a mortgage."

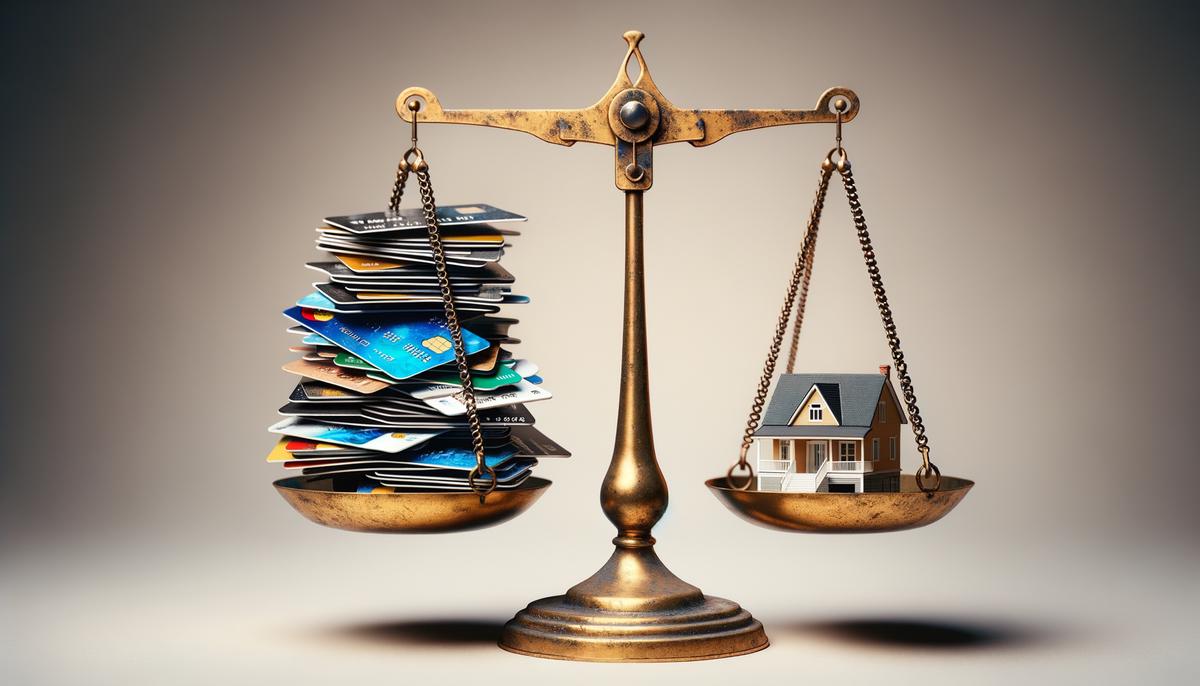

Reduce Credit Card Balances

Lowering your credit card balances isn't just about eliminating high-interest debt; it's about preparing for your mortgage application. Lenders love seeing balances paid down because it showcases you as a responsible borrower. Aim for credit utilization below 30%, but single digits are even better!

Strategies to Tackle Your Balances:

- The snowball effect: Target the card with the smallest balance first, then apply that amount to the next smallest balance once it's paid off.

- The avalanche method: Pay down your highest interest rate cards first. It's financially smart as it saves more over time.

- Avoid making just minimum payments. They're like financial quicksand, trapping you in endless debt.

- Contact your current card issuers for a credit limit increase. If granted, it immediately lowers your utilization ratio.

- Distribute the debt so each card is comfortably below 30%. Lenders examine each component of the puzzle.

Remember, reducing credit card balances isn't just about freeing up funds. It's about demonstrating financial prowess and showing lenders you can manage debt responsibly. It's your ticket to unlocking that front door of your dream home – and enjoying it stress-free.

Avoid Opening New Credit Accounts

While fresh credit cards with enticing introductory rates and reward points are tempting, this isn't the time to go wild over new credit. Each new credit inquiry can nibble at your score, potentially affecting your mortgage application.

Why It's Important to Resist:

- Hard inquiries can linger on your report for up to two years, reducing your score by a few points each.

- New credit can inflate your debt-to-income ratio (DTI), making it seem like you're struggling financially – even if you're not.

- Mortgage lenders want to see stability, not impulsiveness.

Instead of opening new accounts, focus on maintaining existing ones. Those long-standing accounts are valuable – the longer they've been around, the better they make you look.

Of course, emergencies happen. If you absolutely must take on new debt, be prepared to explain it clearly and honestly to your lender.

Stay focused, stay disciplined, and watch as your stable, steady credit report clears the way to your dream home. Sometimes, boring is beautiful when it comes to credit history!

Become an Authorized User

If you're worried about your credit history, here's a clever trick – become an authorized user on a family member's account with an excellent payment history. This simple move can give your credit score a quick boost.

How It Works:

- Talk to a family member with perfect credit behavior. Share your homebuying plans and ask if they'd add you as an authorized user.

- Once added, most credit card companies will report that account's activity to your credit report. Their timely payments help increase your score faster than you might expect.

- Relax and watch your credit improve. It's a clever shortcut to proving your trustworthiness to lenders, without waiting years for your own history to develop.

One word of caution: Ensure the person you're asking is financially stable and consistently repays debts. If their once-excellent payment record deteriorates, it can affect your score too.

This method is particularly beneficial if you're new to credit or have had a few missteps. It shows lenders you have the backing of a solid credit history and improves your chances of securing those desirable lower interest rates.

So reach out to that financially savvy family member and watch your credit score rise. Your dream home might be closer than you think!

Remember, monitoring your credit and making wise financial decisions can bring you closer to homeownership. By staying proactive and diligent, you'll be well-prepared for the exciting journey ahead. Happy home hunting!

- Federal Trade Commission. Common Credit Report Errors and How to Fix Them. Washington, DC: FTC; 2021.