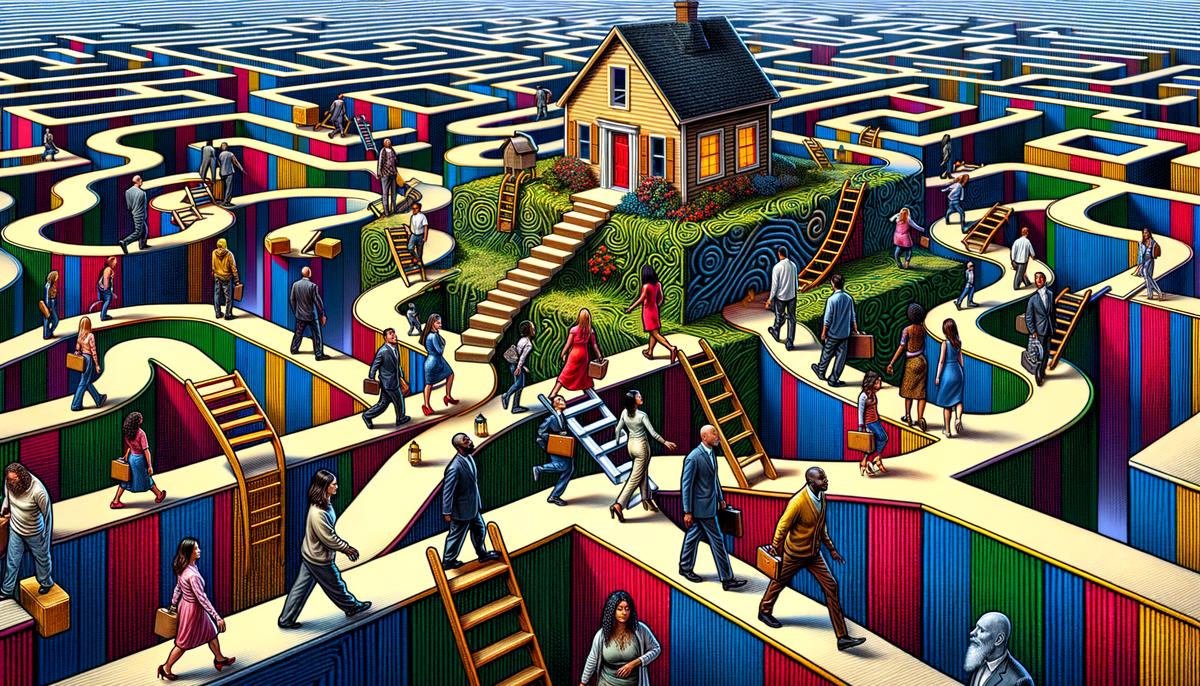

Understanding the Market

The housing market isn't just a numbers game; it's an art of reading between the lines. Recent sales in a neighborhood can set precedents, sometimes inflating prices. When a single home sells for more than its worth, it can cause a ripple effect. This can result from out-of-town buyers or relocation companies paying top dollar. To avoid being misled, spend extra time reviewing sales over the past two years.

Life changes can impact your home-buying decisions. People often buy homes knowing they'll move within a few years, overlooking the costs involved. Buying a house isn't like switching apartments; it takes a significant chunk out of your wallet—around 3% to buy and 6% to sell. If the property doesn't appreciate by at least 10%, you might be losing money. Planning to keep the property as a rental may not be a solution, as refinancing on an investment property often carries higher interest rates.

Another common pitfall is overestimating what you value in a neighborhood. Buying near a dog park or trendy cafes might be perfect now, but will it hold value for others? What you find charming may be insignificant, or even a drawback, to future buyers. Balance your personal preferences with long-term marketability.

Hidden Factors Affecting Home Values:

- Future growth in surrounding areas

- New retail spaces in neighboring areas

- Transportation projects

- School district changes

Don't fixate solely on asking prices. While haggling over the price, an unnoticed increase in interest rates can cost you far more over time. Half a percent difference in your interest rate can add thousands in additional interest over a 20-year period. Focus on locking in a low-interest rate rather than squabbling over a few thousand dollars up front.

Being aware of a home's condition is vital. A house with a low price tag might be hiding costly repair issues. Before making an offer, do thorough inspections to find hidden problems. Don't rush into a purchase out of convenience or pressure; research until you get the best deal, perhaps with help from a real estate agent. Tools like Zillow can give you an idea of local home prices, providing leverage for smart negotiations.

Consider looking beyond your preferred area to discover potentially growing localities. Leasing out might not always be a viable backup plan if managing from afar, so detailed financial planning is necessary. Understanding market highs and lows can prevent overpaying.

"Negotiating home prices isn't merely about the listed figure. Factor in maintenance costs, future renovations, and related expenditures when calculating the total price."

Sometimes, sellers prioritize quick closing times or renting back a property temporarily. Making accommodations could get you a better overall deal.

Never underestimate the power of negotiation, which isn't solely about reducing the price but may include repairs and seller concessions. If an inspection reveals issues, focus on negotiating repairs or ask for price reductions to cover those fixes.

Falling in love with a home can cloud judgment. Skipping formalities like inspections or contingencies to close a deal fast can backfire. Stick to essential checks and balances, like getting an appraisal. Be ready to walk away from a bad deal, even if it's your dream home. Overpaying can have long-term financial repercussions.

Consider making extra mortgage payments in the early years. One extra payment in the first year can save significantly on interest over time. Multiply this effort annually, and you could shave years off your payment schedule. Focus on long-term financial health to keep your home investment worthwhile.

Evaluating True Costs

Owning a home requires serious foresight and financial planning. Evaluating the true cost of homeownership means considering future life changes and potential maintenance issues.

When buying a home, think ahead. Will this house still meet your needs in 5, 10, or 20 years? Does it have enough space for potential family growth, or is it adaptable to changes like aging in place or remote working? Planning for these possibilities will save you from needing to move again sooner than expected.

Every property has its quirks and defects. A minor roof leak or an old furnace can quickly become expensive to fix. Comprehensive home inspections are essential. Setting aside a rainy day fund exclusively for home repairs means you won't be blindsided by unexpected expenses. Generally, allocate 1-3% of your home's value annually for upkeep.

Hidden Costs to Consider:

- Property taxes

- Homeowners insurance

- HOA fees

- Utilities

Don't forget about these hidden costs. They aren't always listed upfront but can significantly impact your budget. When crunching your numbers, make sure to account for all these extra fees.

Consider future-proofing your investment. Think about resale values if you decide to move someday. Ask yourself if the neighborhood's planned developments, the nearby schools' reputations, or local economic trends hint at promising price appreciation. Coupling your gut feeling with sound market research provides a solid financial safety net.

By considering the entire picture instead of focusing on just the purchase price, you're not only buying a house but investing in a home that will grow with you. Balancing your dream-home desires with pragmatic, future-facing calculations equips you with the ultimate toolkit for smart homebuying.

Negotiation Pitfalls

Avoiding common negotiation mistakes can prevent turning your perfect home into a financial burden. Let's break down these traps to ensure your homebuying journey has a happy ending.

A classic blunder is fixating on the house price while letting interest rates slip under your radar. It's easy to haggle over a few thousand dollars, but a slight uptick in interest rates can cost you far more over time. Prioritize securing a low-interest rate and lock it down early. Time your rate locks carefully, ready to act at the perfect moment.

Another misstep is getting fixated on minor repairs while ignoring major issues. Negotiating for small fixes while overlooking structural or mechanical systems can leave you with unforeseen expenses. Focus on the big-ticket items—the roof, HVAC, plumbing, electrical systems, and foundation. It's better to negotiate with the seller on these significant repairs than save a couple hundred on minor issues you can handle later.

Key Contingencies to Maintain:

- Appraisal contingency

- Inspection contingency

- Financing contingency

Waiving these contingencies is a risky move. They protect you if the house doesn't appraise for the agreed price or if inspections uncover hidden issues. Keep these contingencies; they're your safety net as a buyer.

Understanding seller motivations can give you an edge. Are they in a hurry to move due to a job transfer or personal circumstances? Craft your offer to their needs, and you're more likely to succeed. Being accommodating can sometimes outweigh throwing extra cash on the table.

Leverage appraisal contingencies wisely. If an appraised value comes in lower than your offer, it's time to renegotiate or consider walking away. You shouldn't pay more than the house's worth unless you have a compelling reason.

"Prepare thoroughly for inspections. Go beyond the basic inspection by bringing in experts to assess potential issues like mold, pests, or aging sewer lines."

Conduct a radon test if necessary. Use inspection reports to your advantage—ask the seller to handle major repairs or adjust the sale price accordingly.

Think strategically, not emotionally. Don't focus solely on minor price negotiations or superficial repairs. Investigate thoroughly, anticipate potential issues, and negotiate wisely. Craft your offer to the seller's needs, hold onto those contingencies, and prioritize your long-term financial health.

With these strategies in mind, you're well-equipped to navigate the negotiation process. Your dream home awaits—go claim it with confidence and smart decision-making!

Financial Strategies

Let's explore some smart ways to make your money work for you when buying a home. Owning real estate can be complex, but with the right strategies, you can turn it into a great opportunity.

Extra mortgage payments can lead to significant savings. For example:

- $300,000 mortgage at 3.5% interest rate over 25 years

- Monthly payment: ~$2,100 (including taxes and insurance)

- Making one extra payment in the first year saves ~$4,500 in interest over the loan's life

- Making an extra payment each year could save ~$31,000 in interest and pay off your mortgage years earlier

Avoiding PMI (Private Mortgage Insurance) is another smart move. If your credit score is 650 or higher, look for non-PMI loans. PMI can add hundreds to your monthly payment, which could be better spent on home improvements or energy-efficient appliances. Consider these options:

- Conventional loans requiring as little as 3% down

- FHA loans with 3.5% down

- Specialized programs like NACA that don't require PMI

Understanding the potential for growth in surrounding neighborhoods is crucial. Pay attention to future development plans in the area. New shops, schools, or transportation projects can increase your home's value over time. You're essentially benefiting from economic progress without additional upfront costs.

Remember to calculate the property's total expenses beyond the mortgage. HOA fees, property taxes, and seasonal utility costs can add up. Keep a careful budget and consider a contingency fund for unexpected repairs or maintenance.

Periodically check the market for refinancing opportunities as interest rates fluctuate. If you can secure a lower interest rate, you'll save more in the long run, freeing up cash for renovations or investments.

Regularly assess whether to adjust your loan term based on your financial situation. While paying off your mortgage early might seem appealing, it's not always the best choice if it means withdrawing from high-yield investments. Balance is key.

By making extra mortgage payments, shopping for non-PMI loans, forecasting neighborhood potential, and regularly reviewing your budget and refinancing options, you can make smart, long-term financial decisions in your home-buying journey.

Understanding the market and evaluating true costs are essential steps in making a smart home purchase. By balancing personal preferences with long-term marketability, planning for future needs, and staying financially savvy, you can turn the complex process of buying a home into an exciting journey. Remember, it's not just about finding a house; it's about investing in a place that will grow with you over time.