1. Spending Beyond Your Means

Home-hunting excitement can make wallets seem endless, but don't be fooled. It's tempting to stretch finances when that dream house is just a bit out of reach. Yet, signing up for endless debt is not the path to happiness. Get clear on your budget and commit to it. Remember, a mortgage is a long-term commitment—consistent and demanding.

Think about what the future holds. There's life beyond mortgage payments—utilities, maintenance, and those sneaky property taxes. Before you settle, tally up all costs. Understand them. Keep your big-picture goals in mind. A home that makes financial sense sets the stage for a happy life. Seek homes that invite peace, not stress.

"All it takes is one simple error to make them completely regret that expensive mortgage."

To avoid this pitfall:

- Start with lower-cost houses and work your way up

- Consider the long-term impact of monthly payments

- Factor in additional costs beyond the mortgage

2. Trusting the Wrong Realtor

Picking the right realtor is crucial in your house-hunting journey. You deserve someone who understands local market nuances, can predict real estate trends, and knows the hidden gems that don't even make it to Zillow. Your agent should be a local legend, or at least someone who can tell you where to score the best coffee in town (crucial intel when unpacking those moving boxes).

So, how do you find this ideal agent? Interview several candidates. Ask about their track record, dig into references, and get a feel for their communication style. Are they attentive? Do they listen more than they talk? And most importantly, do they vibe with your vision of home sweet home?

Remember, a great realtor is like a great pair of sunglasses—they help you see things clearly and protect you from getting burned. With the right person steering your home journey, you'll not only avoid disasters but might even enjoy the ride!

3. Neglecting to Get Pre-Approved

Mortgage pre-approval isn't just a formality; it's your golden ticket to confident home-buying territory. Before you start mentally hanging curtains or planning housewarming parties, make sure your finances have the green light.

Here's why pre-approval matters:

- It acts like a backstage pass to the fast lane of home purchasing

- Assures sellers that you mean business

- Helps align your dream home desires with financial reality

- Saves you from heartache of falling for unaffordable homes

The reality check comes with perks: a clear understanding of your budget, better negotiation power, and a complete avoidance of wild goose chases. So before your house hunt truly begins, grab that pre-approval letter and brandish it like the empowered homebuyer you are!

4. Skipping the Home Inspection

Think of a home inspection as a first date with your future house, where a trusty professional inspector acts as your wingman, revealing all the secrets hidden behind that charming facade. Every home has its mysteries, and you want to be the detective on this case.

A good inspector is like your very own Sherlock Holmes. They'll scour your prospective home from top to bottom, checking the roof, the wiring, and all the nooks and crannies in between. What they reveal can be pivotal: a creaky floorboard here, a temperamental furnace there, or, heaven forbid, a case of major structural issues.

Sure, finding out that your dreamy home is more fixer-upper than move-in-ready might feel disappointing. But wouldn't you rather tackle those issues head-on—ideally before your furniture arrives? With an inspection under your belt, you can:

- Negotiate repairs

- Rethink your purchase if necessary

- Avoid inadvertently buying a never-ending renovation project

Don't let the allure of moving day rush you past this critical phase. A thorough inspection grants you the real story behind the smiley real estate ad and saves you from potential headaches down the road.

5. Overlooking Future Needs

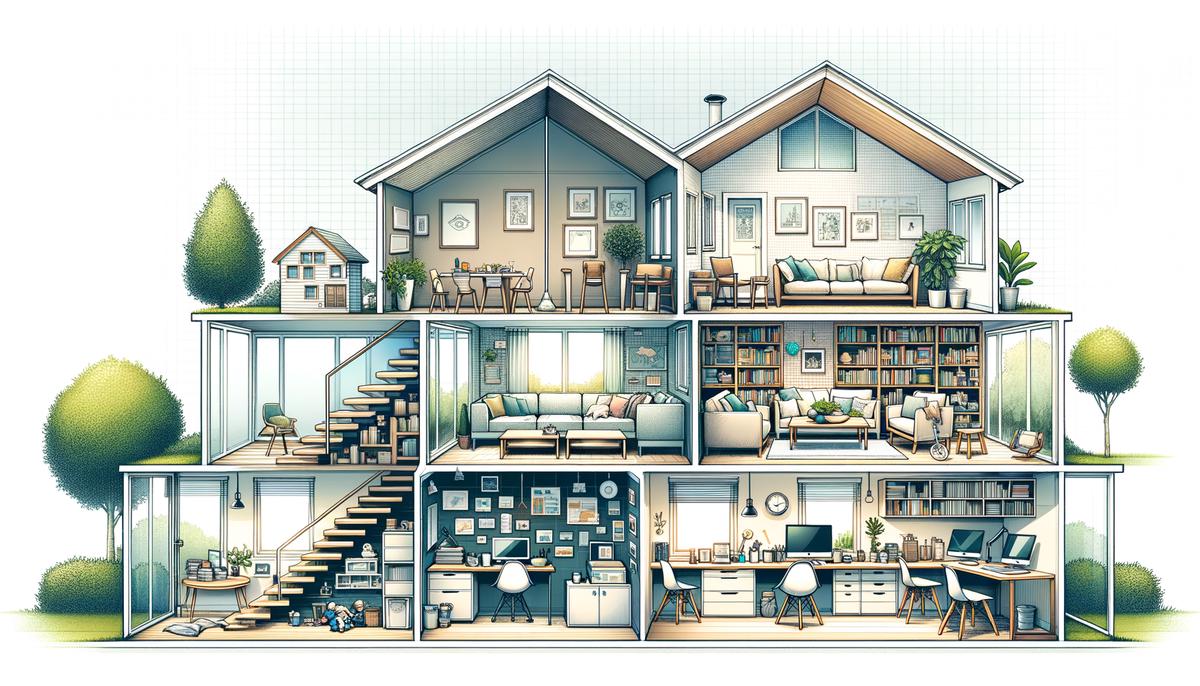

Setting foot into your newly purchased abode is thrilling—it's all fresh paint, blank slate, and boundless potential. But before you get too swept up, take a moment to pause and ponder the future.

Maybe today, it's just you, but what happens when your life situation changes? Consider how your needs might evolve:

- Dream of a growing family? Factor in more bedrooms or a yard.

- Planning to launch a home-based venture? That cozy den could become your future empire's HQ.

Remember, when buying your home, don't just consider what life looks like today—project that vision forward a couple of years. Will your abode of choice grow with you, or will it feel like wearing last season's shoes that pinch just right?

A home is not just a space, but a living story—one that will house your unfolding journey comfortably and delightfully. Engage your imagination, see what the future could hold, and transform your humble dwelling into a fortress of long-term joy.

In the journey of homeownership, one truth stands out: finding a place that aligns with your financial and personal goals is key to long-term happiness. Keep your eyes on the prize—a home that offers peace, joy, and a future filled with promise.

- National Association of Realtors. Profile of Home Buyers and Sellers. Washington, DC: NAR; 2021.

- American Society of Home Inspectors. Standards of Practice. Des Plaines, IL: ASHI; 2019.

- Consumer Financial Protection Bureau. What is a mortgage loan preapproval? Washington, DC: CFPB; 2020.